Integrating our several practice areas, our appellate team has briefed and argued more than two hundred appeals in a broad array of legal issues, including property rights, business and/or trust administration, zoning, real estate and beyond. Carrying a tradition of more than a century of collective experience, each lawyer combines legal scholarship with the art of oral argument; each is prepared for oral argument by undergoing a rigorous “moot court,” where the firm’s most experienced advocates assist appellate counsel in framing the issues in the most positive light for clients.

Our appellate attorneys have been repeatedly recognized as leaders in the field of appellate practice, and receive referrals from other attorneys and have served as counsel for amicus curiae (“friend of the court”).

Consider MM&C to help you in these Appellate matters:

- Appeals Before All Federal and State courts in Maryland, Virginia and the District of Columbia

- Appeals from administrative agencies, including the Maryland Tax Court, the Montgomery County Board of Appeals, and the Montgomery County Planning Department

- Referrals from other attorneys

- Amicus Curiae

- Administrative Agency Appeals

Testimonials

Appeals Representative Cases

Baltimore City v. Kevin Davenport

Circuit Court for Baltimore City, Case No. 24C18005103: Ms. Feuerherd represented a couple who had owned and operated and/or leased a corner grocery store for more than 25 years, before Baltimore City targeted the property for condemnation. Prior to the jury trial, the City’s offer to purchase the property was just $36,000. But the grocery store was income-producing rental property, with a second floor having potential for residential apartments; capitalizing on this value, Ms. Feuerherd successfully persuaded the jury to return a verdict of $196,250.

Chod v. Montgomery County Board of Appeals

Circuit Court for Montgomery County, Case No. 398704-V: On behalf of a local commercial property owner, Ms. Feuerherd challenged the Water Quality Protection Charge (also known as a “rain tax”), through the administrative appeals process to a successful appeal in the Circuit Court for Montgomery County.

Montgomery County v. Phillips

445 Md. 55 (2015): Before the Court of Appeals of Maryland, Ms. Feuerherd briefed and argued on behalf of owners of a family farm, and persuaded a majority of the Court that Montgomery County overcharged its farmland transfer tax in violation of the state tax cap.

Tomares, et ux. v. Poss, et al.

Circuit Court for Montgomery County, Case No. 418365V: A family retained Ms. Feuerherd and Miller, Miller & Canby after an old gravel road, which provided the sole access to their property, was cut off by a neighbor who challenged that the road was a private driveway. Navigating through 230 years of state, county and railroad records and title history, together with a myriad of expert and lay witness testimony and complex legal issues, Ms. Feuerherd successfully proved that the gravel road was indeed a public road dating back to 1793.

MORE ON Litigation

Business & Commercial Litigation

Just as Montgomery County has grown more sophisticated and diverse in the last half century, so has the firm’s Business & Commercial Litigation practice. Our...read more →

Personal Injury & Insurance Litigation

An unexpected injury causes turmoil and hardship. During this difficult time, it is important to receive expert, caring and effective advice and representation from...read more →

Real Estate Litigation

Miller, Miller & Canby attorneys bring 75 years of trial skills and deep knowledge of real property to this field, which other practitioners tend to treat...read more →

Construction Litigation

The construction of a new building or the build-out of existing space should be cause for celebration. Unfortunately, disputes often arise between the owner and...read more →

Employment Litigation

We work with both employers and senior employees to avoid problems with well-negotiated and drafted agreements at the outset of a relationship. Experienced counsel...read more →

Estates & Trusts Litigation

Representing a variety of stakeholders, including personal representatives, trustees, guardians, beneficiaries or heirs, and creditors, our trial attorneys have...read more →

Maryland Real Property Tax Appeals

Every year, we challenge the assessments of various types of property that are over-valued by the Department of Assessments and Taxation. We have broad experience...read more →

Latest News

-

Miller, Miller & Canby Litigators Prevail in Two Recent Montgomery County Circuit Court Cases

Litigation attorneys Joe Suntum and Lisa Blitstein recently prevailed on behalf of their clients in a contentious case stemming from the sale between family...read more →

-

Maryland Property Tax Assessments Continue to Increase

The Maryland Department of Assessments and Taxation (SDAT) divides all residential and commercial properties into three groups. On a rotating basis, each group is...read more →

-

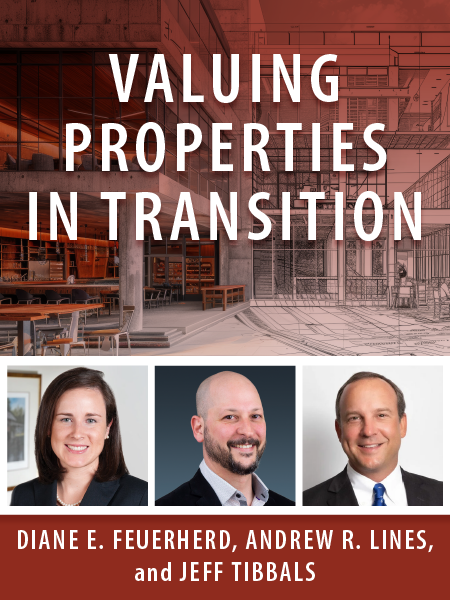

MM&C Attorney Diane Feuerherd Contributes to Article “Valuing Properties in Transition” for ALI CLE

The American Law Institute CLE (ALI CLE) recently published an article on its blog examining why understanding potential for a highest and best use that differs...read more →