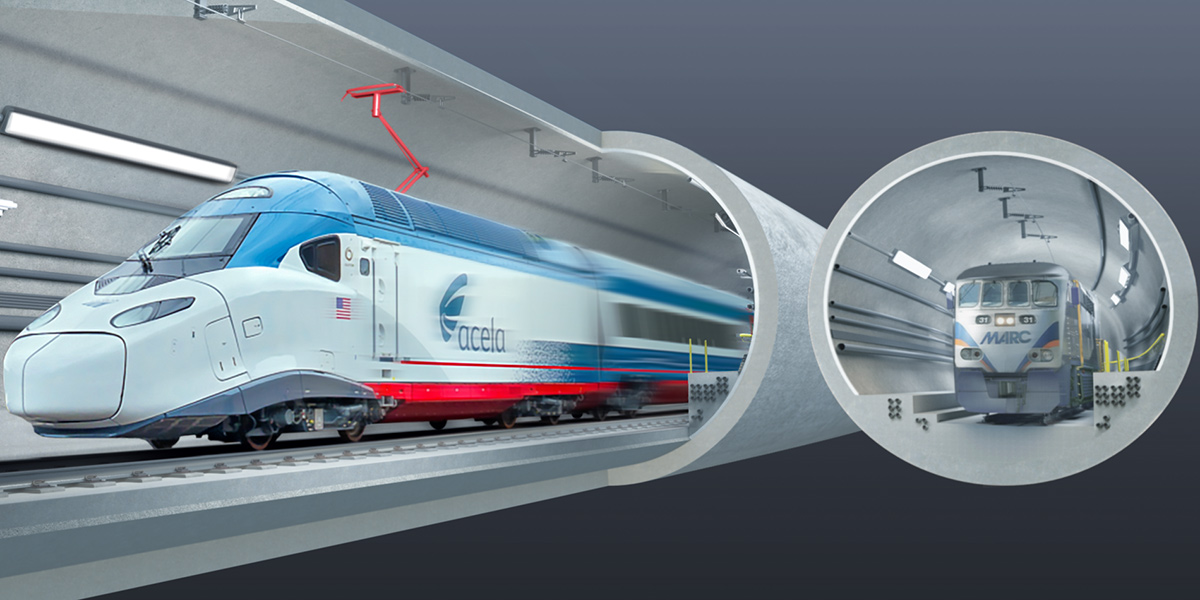

Amtrak’s New Frederick Douglass Tunnel Project

Amtrak has initiated its Frederick Douglass Tunnel Project, to construct new twin railway tunnels through West Baltimore. It will replace its...read more →

New Appeal Rights in Virginia

In a major change to civil practice and procedure in Virginia, the Virginia Court of Appeals is now accepting appeals as “a matter of right.”...read more →

5G Update: FCC Seeks Public Input on Utility Pole Replacement Cost-Sharing in Order to Streamline 5G Connectivity Upgrades

As reported by Inside Towers, the FCC wants to minimize disputes over utility pole attachments before the $65 billion in broadband infrastructure...read more →

MMC Litigation Attorney Diane Feuerherd Interviews the Honorable E. Gregory Wells for Maryland Appellate Blog

Click here for Diane Feuerherd’s latest post to the Maryland Appellate Blog, featuring an interview with the next Chief Judge of the Court of...read more →

February Deadline Approaching for Maryland Property Tax Assessment Appeals

At the end of December, the Maryland Department of Assessments and Taxation (SDAT) issued new Assessment Notices to owners of one-third of all...read more →

Miller, Miller & Canby Welcomes Attorney Alexandra Mussler to Firm’s Litigation Practice

Miller, Miller & Canby is pleased to welcome attorney Alexandra L. Mussler to the firm’s Litigation group. Ms. Mussler focuses her practice in...read more →

Litigation Attorney Raymond Gambrill Elected Treasurer of the J. Franklyn Bourne Bar Association

Miller, Miller & Canby attorney Raymond Gambrill was nominated and elected Treasurer of the J. Franklyn Bourne Bar Association. Along with the...read more →

Zoning and Land Use Attorney Jody Kline elected President of George Washington Chapter of Lamda Alpha International

Miller, Miller & Canby’s Jody Kline has been elected President of the George Washington Chapter of Lamda Alpha International (LAIGW). Lamda...read more →

MM&C Litigation Attorney Prevails for Client Featured in NBC4 News Story

MM&C client Mark King was featured in a NBC4 news story concerning an online marketing coach who charged thousands of dollars for his “get...read more →